20 percent down payment calculator

In theory down payment requirements for a condo should be similar to those for a single-family home. We use live mortgage data to calculate your mortgage payment.

Down Payment Calculator How Much Money Do You Need

The minimum down payment for a mortgage can be much lower and heres how.

/MortgateRates.Fed.StL-0099d59e398e4f239bc0cc4154e04cb7.jpg)

. Output current as measured in milliamps from the 4-20 mA transducer. Department of Housing and Urban Development HUD provides a discount of up to 50 percent on a home with a down payment of just 100. Mortgage Type Loan Limits.

A down payment is the portion of the cars price that you pay upfront. 100 home price percent - 25 down payment per cent 75 loan-to-value ratio. Longer time to enter the.

Use our free Extra Payment Calculator to find out just how much money you are saving in interest by making extra payments on your auto home or other installment loans. The minimum down payment required for a conventional loan is 3. The 4-20 ma calculator exactly as you see it above is 100 free for you to use.

The idea that buyers need to put at least 20 percent down on a home isnt true. We use mortgage loan limits down to the county level to identify if a user qualifies for an FHA or Conforming loan. Banks also offer mortgages with easier qualifications but this might not be the best.

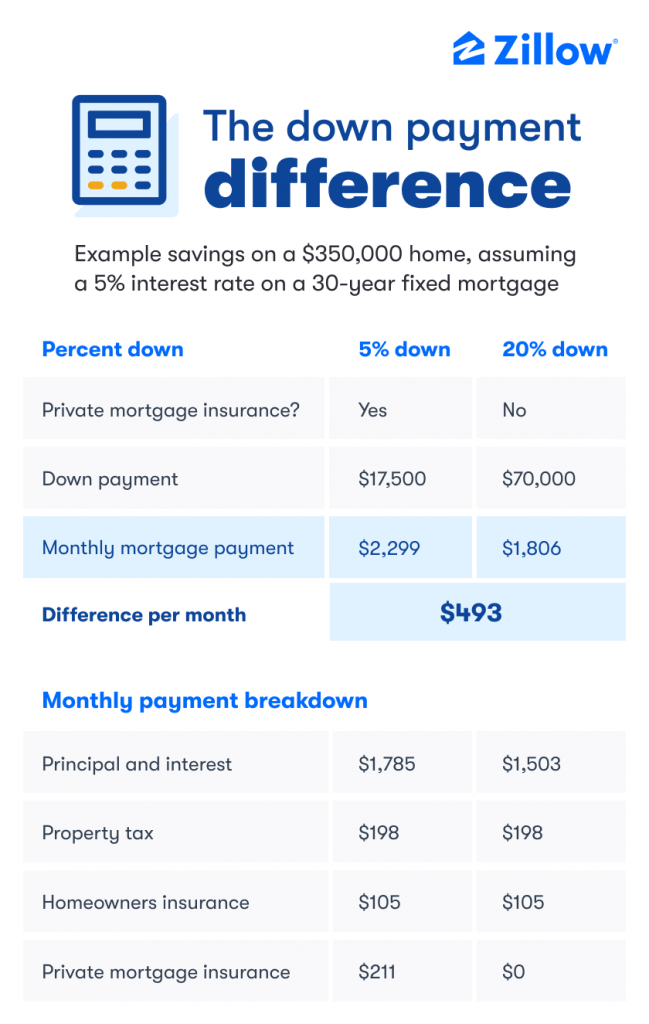

We assume a 30-year fixed mortgage term. After you have concluded your calculation you can use the payment schedule button at the bottom of the calculator to create a printable amortization schedule of your payments. Youll need to put 20 down if you want to avoid buying private mortgage insurance PMI.

The program sponsored by the US. Depending on the home you may also have condo association or. You can pay down the principal and reduce interest charges each and every month.

If youre able to put 20 down on your home youll reap a few key benefits. You dont have to make a 20 down payment to buy a house. The long answer though is more complicated.

You dont have a trade-in and you choose a 48-month loan at 4. Smaller home loan balance. Mortgage Down Payment Calculator.

The output of the transducer is an electrical signal to be sent down a transmission line and is measured in milliamps. PMI is insurance that protects your lender if you default on. The short answer is 3 percent to 20 percent of your units purchase price with 10 percent being common for those buyers who must rely on conventional loans to finance their units.

If you put three percent down into a mortgage calculator it will calculate the mortgage insurance for you automatically. According to Opendoors report 82 of Gen Xers and 93 of millennials say theyd need to save up for a down payment. For example a well-qualified customer could lease a 2022 Hyundai Tucson with 3699 down for a 219 monthly payment for 36 months at the time of this writing.

With 20 percent down and no mortgage insurance your monthly principal and interest payment comes out to 1150. The great thing about PMI is that it helps you buy a house with less than 20 down. Is separate from homeowners insurance if you input a down payment of under 20 in our calculator youll have a PMI estimate as well.

As a general rule you should pay 20 percent of the price of the vehicle as a down payment. In the calculator the following inputs are called for. In 2021 some banks offered near 100 financing for a home with a 3 down payment being a widely advertised mortgage option.

With 10 percent down and mortgage insurance included payments jump to 1450 per. Use the calculator below to update your estimated monthly. Avoid PMI without a 20 down payment.

And the minimum down payment for an FHA loan is 35. A 20 down payment is a significant amount of money for most people. The highest price home you could buy with three percent down would be about 430000.

For a 350000 home bought with a 10 percent down payment of 35000 the principal balance at the beginning of the mortgage will be 315000. The HomeReady low down payment home loan allows for buyers to obtain loans up to 417000 with 3 down. The above calculations presume a 20 down payment on a 250000 home a closing cost of 3700 which is rolled into the loan.

Certain couples may also qualify for an FHA loan which eliminates the need for a large down payment. While there are good reasons to consider a large down payment you should also be aware of four potential drawbacks. The typical down.

But still a 20 down payment is considered ideal when purchasing a home. The monthly payment amount shown is based on information you provided and is only an estimate. How to Use the Money Under 30 Car Affordability Calculator.

If the same car manufacturer provided a no-money-down offer your. Your budget is 35 or 14000 and you plan to make a 20 down payment of 2800. Use HSHs Down Payment Decisioner sm Calculator.

The savings can add up over time and total in the thousands depending on the amount. Lets pretend that you make 40K a year. It does not include other costs of owning a home such as property taxes and insurance.

We have built local datasets so we can calculate exactly what closing costs will. A 20 down payment is widely considered the ideal down payment amount for most loan types and lenders. If youll be using an adjustable-rate mortgage this amount only applies to the fixed period.

Because youve paid for part of the car with it it lowers the amount of money you need to borrow and thus lowers your monthly loan payment. Here are six advantages of making a house down payment of 20 percent or more. If you select the minimum payment percentage option when monthly payments fall below 10 we will apply a 10 mininum until the card is paid off.

You can use the following calculators to compare 20 year mortgages side-by-side against 10-year 15-year and 30-year options. Avoiding the Down Payment. In the case of a lease automakers typically run lease deals with various monthly payments based on the down payment amount.

If the purchase price is 1000000 or more the minimum down payment is 20. But on the downside its an additional fee you have to pay each month. Mortgage default insurance commonly referred to as CMHC insurance protects the lender in the event the borrower defaults on the mortgage.

Some special loan programs even allow for 0 down payments. Disadvantages of a large down payment. In 2021 the typical down payment for first-time home buyers was 7 according to the National Association of Realtors.

You may have heard this referred to as the 20 rule.

House Downpayment Savings Goal Calculator How Long Will It Take To Save Up To Buy A Home

How To Determine The Down Payment On A Car Yourmechanic Advice

Va Mortgage Calculator Calculate Va Loan Payments

How Much Is A Down Payment On A House Zillow

Simple Loan Calculator

How To Determine The Down Payment On A Car Yourmechanic Advice

15 Year Mortgage Calculator Calculate Local 15 Yr Home Loan Refi Payments Nationwide

Mortgage Payment Calculator Nerdwallet

How To Determine The Down Payment On A Car Yourmechanic Advice

Bi Weekly Loan Calculator Biweekly Payment Savings Calculator

How Much Is A Down Payment On A House Do You Need 20 Percent Thestreet

Auto Loan Calculator Calculate Car Loan Payments

Down Payment Calculator How Much Money Do You Need

Excel Formula Estimate Mortgage Payment Exceljet

/MortgateRates.Fed.StL-0099d59e398e4f239bc0cc4154e04cb7.jpg)

Mortgage Calculator

Discount Points Calculator How To Calculate Mortgage Points

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information